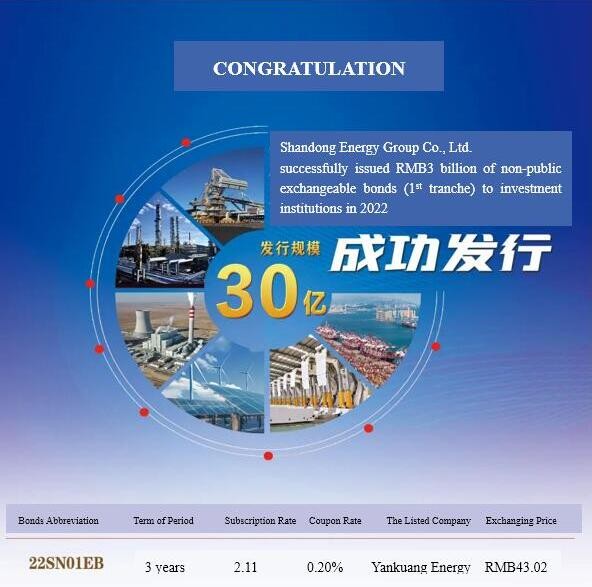

On April 19, 2022, the exchangeable bonds issued by SDE on the Shanghai Stock Exchange (hereinafter referred to as the "issuance") were successfully priced. The underlying stock was Yankuang Energy's A-share stock (600188.SH). The bond term is 3 years and the amount is RMB3 billion. The exchanging price is up to RMB43.02 per share, higher than the historically highest stock price of Yankuang Energy. The issuance represents SDE’s debut on the exchange market ever since its reorganization in July 2020. Besides the record high exchanging price, the issuance attracted enthusiastic investment by market institutions, which not only consolidated the long-term bullish growth of the stock price but also shown the investors’ recognition of SDE’s credit qualification and the expected growth of Yankuang Energy’s stock price.

Debut on the Shanghai Stock Exchange

Showcase the Comprehensive Strength of Shandong Energy

This is the first bond issuance on the exchange market by Shandong Energy Group after its merger. The issuance fully demonstrated SDE’s achievements and credit qualification as well as its strength as the 70th strongest enterprise in the Fortune Global 500 List and the only company across Shandong province with total assets and operating revenues all up to "RMB750 billion".

Hit new high of stock exchanging price

Build long-term investment confidence

The exchangeable bonds belong to a kind of hybrid securities products, issued by the shareholders of listed companies. Bond investors can swap the bonds they are holding for the equity of the underlying listed company, at the agreed exchange price during the pre-set exchange period. In short, it is a swap option embedded in the bond.

The final exchanging price of the bond is RMB43.02 per share, with a premium rate of 15.95% compared with the closing price of RMB37.10 on the day before the issuance announcement, and a premium rate of 25.42% compared with the closing price of RMB34.30 on the day of the announcement of the issuance. Meanwhile, it is also higher than the historically highest stock price of Yankuang Energy's A-share stock (600188.SH) since its listing.

Unveil innovative bonds

Demonstrate diverse financing channels

The exchangeable bonds are an innovative product at an annualized coupon rate of 0.20%. Given the case that the investors choose not to exchange stocks, SDE will realize low-cost financing, which reflects the market recognition of SDE’s business development and financial stability.

Examine the market environment

Base on the development of the listed company

Due to the special nature of exchangeable bonds, the fluctuation of the underlying stock price has a direct influence on the stock exchanging price. Since 1 April, the A-share market has seen drastic fluctuation, causing the price of the underlying stock fluctuate accordingly. Before the issuance, SDE had paid full attention to the market dynamics and examined the timing of issuance in a prudent manner. An emergency plan was formulated when the stock price fluctuated high, and full analysis was made when the stock price went down temporarily before the issuance, which strengthened SDE’s confidence and enabled the issuance a success at the right time.

Investment institutions swing into action

Embody full recognition of SDE’s credit qualification

The amount of issuance is RMB3 billion, up to the pre-set capping, also the largest one of its kind throughout recent years. The issuance has attracted extensive attention from domestic and foreign investors, including well-known funds, asset management companies, insurance companies, banks, securities companies and various institutional investors, with 2.11 times of subscription. In doing so, SDE’s brand image has been further burnished, paving the way for SDE's ensuing capital market operation.

Ambitious to be a world-class enterprise, Shandong Energy Group will give full play to its overall advantages, put into action Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, implement the new development philosophy, integrate into the new development pattern, focus on "six business segments" of mining, electricity power, high-end chemicals, high-end equipment manufacturing, new energy and new materials and modern logistics and trade, promote“three transformations" in development mode, management & control mechanism and production organization methods. By the end of the 14th“Five-Year Plan”(2021-2025), SDE is projected to realize both total assets and operating revenues up to RMB1 trillion each and become a global clean energy supplier and a world-class energy enterprise.